Tuesday, December 31, 2013

Friday, December 20, 2013

Nifty update

Although the rise today took many by surprise, Nifty is very close to an important resistance, and if that level is not crossed, a very bearish pattern is developing.

The resistance is near 6306 - 6310 on Nifty spot, which is the 61.8% retracement level of the previous fall from 6415 to 6129.

If Nifty cannot cross this level on Monday, it will also complete a bearish flag pattern.

If this bearish flag pattern works, the confirmation will be below 6200 on Nifty spot, and this pattern gives a target of below 5950.

The options data also indicates resistance at higher levels.

6200 CE made a double top at 115 (yesterday and today), thus not crossing this will be a first sign of bears gaining the upper hand.

Secondly, although the PCR at 6200 is a healthy 1.76, (which indicates expiry above 6200), the PCR at 6300 is still only 0.59, which doesn't show any intent by Nifty to cross and sustain above 6300.

3 things to keep an eye on for coming days:

1. Nifty spot not closing above 6310.

2. 6200 CE not crossing 115.

3. PCR at 6300 strike price not rising to 0.9 or 1.

One can buy cheap January OTM puts (6100 or 6000) near 6300 spot with a SL above 6320, in anticipation of the bearish flag coming into play.

If that pattern works, these OTM puts can prove to be multibaggers.

The resistance is near 6306 - 6310 on Nifty spot, which is the 61.8% retracement level of the previous fall from 6415 to 6129.

If Nifty cannot cross this level on Monday, it will also complete a bearish flag pattern.

If this bearish flag pattern works, the confirmation will be below 6200 on Nifty spot, and this pattern gives a target of below 5950.

The options data also indicates resistance at higher levels.

6200 CE made a double top at 115 (yesterday and today), thus not crossing this will be a first sign of bears gaining the upper hand.

Secondly, although the PCR at 6200 is a healthy 1.76, (which indicates expiry above 6200), the PCR at 6300 is still only 0.59, which doesn't show any intent by Nifty to cross and sustain above 6300.

3 things to keep an eye on for coming days:

1. Nifty spot not closing above 6310.

2. 6200 CE not crossing 115.

3. PCR at 6300 strike price not rising to 0.9 or 1.

One can buy cheap January OTM puts (6100 or 6000) near 6300 spot with a SL above 6320, in anticipation of the bearish flag coming into play.

If that pattern works, these OTM puts can prove to be multibaggers.

Wednesday, December 18, 2013

Nifty update based on Options data

As mentioned a few days back, Nifty took support in the 45-65 band on the 6200 CE, and is now above 100.

The level to watch for this CE is in the 135-145 band.

The PCR at 6200 which had gone alramingly to 0.81 at one point yesterday, rose smartly to 1.285 today; however, the PCR at 6300 is not moving much (0.4 now).

If Nifty rises tomorrow as the above suggests, and the 6200 CE finds it difficult to cross the above resistances, and also the PCR at 6300 does not show signs of moving up, Nifty can top out in that region for the short term.

The level to watch for this CE is in the 135-145 band.

The PCR at 6200 which had gone alramingly to 0.81 at one point yesterday, rose smartly to 1.285 today; however, the PCR at 6300 is not moving much (0.4 now).

If Nifty rises tomorrow as the above suggests, and the 6200 CE finds it difficult to cross the above resistances, and also the PCR at 6300 does not show signs of moving up, Nifty can top out in that region for the short term.

Sunday, December 15, 2013

Top made for 2013, or top made till Lok Sabha elections 2014 ?

The title of this post might shock some bulls, but the price action seems to suggest that a top has been made for this year already.

Moreover options data from January suggest that if Bulls do not act fast in early January 2014, this top might not be crossed in the near future at all, and then the next trigger is only the Lok Sabha elections.

After the assembly election results were out last weekend, Nifty did manage to trade at all time highs almost for the full day, however, the last traded price for the day was below that figure, and only the opening high on Tuesday was above that figure of 6357, after which it has always remained below that previous high.

This is not a good sign after crossing an all time high, which had proved to be such a tough nut to crack on many previous occasions.

A typical book breakout above a 5 year old high should have sustained well above it.

In my view, 'bulls' have only scored brownie points by making a new all time high.

Coming to the current scenario, the 5-day fall last week has caused pain for a lot of bulls, and they will keep looking at every good rise to exit. These will act as resistances in any rise.

Nifty can bottom out from the Friday low or worst case 6140-45 (spot), but there will be resistances at every 50-points rise , the toughest being near 6250 and then 6300-6310.

The 6200 CE chart also suggests something similar. The Friday low of 68 is a good support, failing which, 45 can act as a support.

I do not see it rising beyond 130-140 before the expiry.

Moreover options data from January suggest that if Bulls do not act fast in early January 2014, this top might not be crossed in the near future at all, and then the next trigger is only the Lok Sabha elections.

After the assembly election results were out last weekend, Nifty did manage to trade at all time highs almost for the full day, however, the last traded price for the day was below that figure, and only the opening high on Tuesday was above that figure of 6357, after which it has always remained below that previous high.

This is not a good sign after crossing an all time high, which had proved to be such a tough nut to crack on many previous occasions.

A typical book breakout above a 5 year old high should have sustained well above it.

In my view, 'bulls' have only scored brownie points by making a new all time high.

Coming to the current scenario, the 5-day fall last week has caused pain for a lot of bulls, and they will keep looking at every good rise to exit. These will act as resistances in any rise.

Nifty can bottom out from the Friday low or worst case 6140-45 (spot), but there will be resistances at every 50-points rise , the toughest being near 6250 and then 6300-6310.

The 6200 CE chart also suggests something similar. The Friday low of 68 is a good support, failing which, 45 can act as a support.

I do not see it rising beyond 130-140 before the expiry.

Friday, December 6, 2013

Will Miss Nifty fly in Blue Sky territory on Monday?

The markets have now closed for the weekend, and will now open only after the results for the State assemblies are fully declared.

The bulls and bears have gone home with positions they are comfortable with. A peep into the PCR at various strike prices of Nifty gives an idea of what is likely to happen on Monday.

The PCR at 6200 has risen sharply to 1.96 suggesting that recent lows will be held by bulls even if the election results are not upto expectations (lower than 4 - 0 to the BJP).

One positive sign for the bears to look forward to is the PCR at 6300, which is only 0.44 as of now.

In case of a gap up on Monday, this ratio will come into play, and if there is no huge surge in OI of 6300 PE along with crash in OI of 6300 CE, bears will feel comfortable to go short.

Thus, in case of a gap down on Monday, keep an eye on OI of 6200 CE and PE, and in case of a gap up, on OI of 6300 CE and PE.

However, if PCR at 6300 keeps rising, Miss Nifty might start flying in BLUE SKY territory ( all time highs). The current data however, does not suggest that.

The bulls and bears have gone home with positions they are comfortable with. A peep into the PCR at various strike prices of Nifty gives an idea of what is likely to happen on Monday.

The PCR at 6200 has risen sharply to 1.96 suggesting that recent lows will be held by bulls even if the election results are not upto expectations (lower than 4 - 0 to the BJP).

One positive sign for the bears to look forward to is the PCR at 6300, which is only 0.44 as of now.

In case of a gap up on Monday, this ratio will come into play, and if there is no huge surge in OI of 6300 PE along with crash in OI of 6300 CE, bears will feel comfortable to go short.

Thus, in case of a gap down on Monday, keep an eye on OI of 6200 CE and PE, and in case of a gap up, on OI of 6300 CE and PE.

However, if PCR at 6300 keeps rising, Miss Nifty might start flying in BLUE SKY territory ( all time highs). The current data however, does not suggest that.

Tuesday, December 3, 2013

Monday, December 2, 2013

My take on Nifty for the short term

As can be seen from the chart of Nifty 6200 CE, there is a big resistance in the 188 - 92 band, and unless that is crossed decisively, Nifty can decline.

Longs need to be careful till those levels are held on the CE.

If the CE falls all the way down to the lower support level, Nifty can decline by more than 200 points from here.

Longs need to be careful till those levels are held on the CE.

If the CE falls all the way down to the lower support level, Nifty can decline by more than 200 points from here.

Thursday, November 28, 2013

Wednesday, November 27, 2013

Saturday, November 23, 2013

A classic case of Pump and dump

On 23rd October I happened to receive a text message on my mobile recommending to buy a BSE stock - CUPID TRADE for a target of upper circuit !!

Although I never act on such messages, out of curiosity, as I always do, I decided to check the chart. This stock happens to be listed only on BSE. Since I have charts for all BSE and NSE stocks (historical too), I checked the chart till the previous day, and saw this :

On first glance, it was clearly in an uptrend but with thin volumes (the 20 day moving average of volumes was just 14,400 till that day).

The SMSs to buy increased and then I realised that it was in lower circuit already at 263.1 with a huge volume of 3.79 lakh shares. So the target mentioned was 22% from that price, that too intra day !

The text messages continued till 12 noon and one of the messages was:

I started tweeting about it, and following are my tweets on that stock:

I also saw the long term chart which told a story:

What is the status of that stock today? Here is the latest chart:

The stock has been in lower circuit every single day since that fateful day (22 days), with volumes in 2 and 3 digits.

Imagine the plight of those who bought it on 23rd October based on those SMS messages !!

Moral of the story: DO NOT BUY ANYTHING BLINDLY EVEN IF THE SMS IS FROM GOD !!

Although I never act on such messages, out of curiosity, as I always do, I decided to check the chart. This stock happens to be listed only on BSE. Since I have charts for all BSE and NSE stocks (historical too), I checked the chart till the previous day, and saw this :

On first glance, it was clearly in an uptrend but with thin volumes (the 20 day moving average of volumes was just 14,400 till that day).

The SMSs to buy increased and then I realised that it was in lower circuit already at 263.1 with a huge volume of 3.79 lakh shares. So the target mentioned was 22% from that price, that too intra day !

The text messages continued till 12 noon and one of the messages was:

I started tweeting about it, and following are my tweets on that stock:

I also saw the long term chart which told a story:

What is the status of that stock today? Here is the latest chart:

The stock has been in lower circuit every single day since that fateful day (22 days), with volumes in 2 and 3 digits.

Imagine the plight of those who bought it on 23rd October based on those SMS messages !!

Moral of the story: DO NOT BUY ANYTHING BLINDLY EVEN IF THE SMS IS FROM GOD !!

Friday, November 22, 2013

Sunday, November 17, 2013

A low risk trade idea

Tata Steel has given a strong upmove in the last couple of months and has done well even after results were declared last week.

There is a strong resistance between 376 and 379 (cash), and the stock can give a decline / pullback as long as this resistance is not crossed.

One can buy a Put near the resistance or go short in futures, or go short in 380 CE with a stop loss above 381 cash level.

There is a strong resistance between 376 and 379 (cash), and the stock can give a decline / pullback as long as this resistance is not crossed.

One can buy a Put near the resistance or go short in futures, or go short in 380 CE with a stop loss above 381 cash level.

Range-bound November ?

As mentioned at the start of the November series, this month seems to be a range-bound month as far as Nifty is concerned, between 5950 and 6300.

Nifty seems to have bottomed out for the short term at 5972, but there are resistances near 6140-50 and then 6200-6220.

This view is also supported by the PCR charts, which show a very strong support near 5900-5950 and the support at 6000 is still not very strong.

The PCR at 6100 strike price will provide the hint as regards the way Nifty will move forward. The upmove can gather steam only if the PCR at 6100 moves above 1.25.

This upmove can be halted by supports for the 6100 PE in the range 55-65 and then between 35 - 40.

Nifty seems to have bottomed out for the short term at 5972, but there are resistances near 6140-50 and then 6200-6220.

This view is also supported by the PCR charts, which show a very strong support near 5900-5950 and the support at 6000 is still not very strong.

The PCR at 6100 strike price will provide the hint as regards the way Nifty will move forward. The upmove can gather steam only if the PCR at 6100 moves above 1.25.

This upmove can be halted by supports for the 6100 PE in the range 55-65 and then between 35 - 40.

Thursday, November 7, 2013

Wednesday, November 6, 2013

Tuesday, November 5, 2013

Monday, November 4, 2013

A study based on Options for November

With Nifty futures and sensex having made all time highs, and Nifty spot threatening to do so, here is a study based on Options to try and see what Nifty can do in November.

Based on the Options data, it appears Nifty might remain rangebound within 6100 to 6400 range.

This study based on Options is a bit too early, and can change pretty fast, but any change spotted will be highlighted here immediately.

The 6400 CE chart shows a resistance near the 100 area, and support near the 35-40 area.

One can safely short either the CE or Nifty futures near the resistance zone for a target near the support band.

The current difference is about 50 points on the 6400 CE which means a downside of about 100-150 points on Nifty futures, which gives a target of approximately 6150 on Nifty Spot.

A look at the PCR at various strike prices also reveals a similar scenario.

The PCR at 6300 is still 0.87, thus indicating that Nifty spot is not comfortable above 6300 (CMP 6317).

The PCR at 6400 is extremely less at 0.24 and bulls do not seem to be serious as of now to plan an assault on that level.

On the lower side PCR at 6000 and 6100 is very strong, thus indicating that breaking these levels is going to be difficult in the near future.

Keeping a close watch on how these PCR values change over the next few days will give further hints.

As of now 6150 - 6320 seems to the range for Nifty spot.

TRADE IDEAS:

Go short on rise with that level of 6400 CE as SL (100-102);

Go long on any dip near 6150, with SL as 35-40 on 6400 CE.

Based on the Options data, it appears Nifty might remain rangebound within 6100 to 6400 range.

This study based on Options is a bit too early, and can change pretty fast, but any change spotted will be highlighted here immediately.

The 6400 CE chart shows a resistance near the 100 area, and support near the 35-40 area.

One can safely short either the CE or Nifty futures near the resistance zone for a target near the support band.

The current difference is about 50 points on the 6400 CE which means a downside of about 100-150 points on Nifty futures, which gives a target of approximately 6150 on Nifty Spot.

A look at the PCR at various strike prices also reveals a similar scenario.

The PCR at 6300 is still 0.87, thus indicating that Nifty spot is not comfortable above 6300 (CMP 6317).

The PCR at 6400 is extremely less at 0.24 and bulls do not seem to be serious as of now to plan an assault on that level.

On the lower side PCR at 6000 and 6100 is very strong, thus indicating that breaking these levels is going to be difficult in the near future.

Keeping a close watch on how these PCR values change over the next few days will give further hints.

As of now 6150 - 6320 seems to the range for Nifty spot.

TRADE IDEAS:

Go short on rise with that level of 6400 CE as SL (100-102);

Go long on any dip near 6150, with SL as 35-40 on 6400 CE.

Thursday, October 31, 2013

Wednesday, October 30, 2013

Expiry at 6100 or 6300 ?

The Max Pain of Options for Nifty is near 6100 right now, and there are high chances that expiry might be near 6100.

However, one counter argument is the PCR at 6200 strike price.

This PCR rose steadily yesterday from a low of 0.3 to 0.78.

As seen in the chart, there is a resistance from a double top near 1-1.1 (black line).

If this resistance is crossed by the PCR, the 6200 CE has 100-105 as a target which gives an expiry near 6300.

How to trade this?

Nifty is now overbought on hourly charts, and there is strong chance that it will correct.

On a strong open today, one can buy a 6300 PE near 70-80, with a stop loss 10 points below morning low.

If and when Nifty declines, this PE will rise fast, and can even go to 120-140.

If, during this time, the 6200 PCR is still showing strength, one can then buy a 6200 CE on dip below 20 (54 now). Partial profit booking in the 6300 PE will ensure that this 6200 CE will be free of cost.

Chart of 6200 CE:

However, one counter argument is the PCR at 6200 strike price.

This PCR rose steadily yesterday from a low of 0.3 to 0.78.

As seen in the chart, there is a resistance from a double top near 1-1.1 (black line).

If this resistance is crossed by the PCR, the 6200 CE has 100-105 as a target which gives an expiry near 6300.

How to trade this?

Nifty is now overbought on hourly charts, and there is strong chance that it will correct.

On a strong open today, one can buy a 6300 PE near 70-80, with a stop loss 10 points below morning low.

If and when Nifty declines, this PE will rise fast, and can even go to 120-140.

If, during this time, the 6200 PCR is still showing strength, one can then buy a 6200 CE on dip below 20 (54 now). Partial profit booking in the 6300 PE will ensure that this 6200 CE will be free of cost.

Chart of 6200 CE:

Tuesday, October 29, 2013

Will this trendline act?

A school of thought in TA says that any trendline becomes stronger when re-tested.

The original trend should continue if the trendline is not crossed.

The high on Nifty spot today is bang on the trendline right from 1st October.

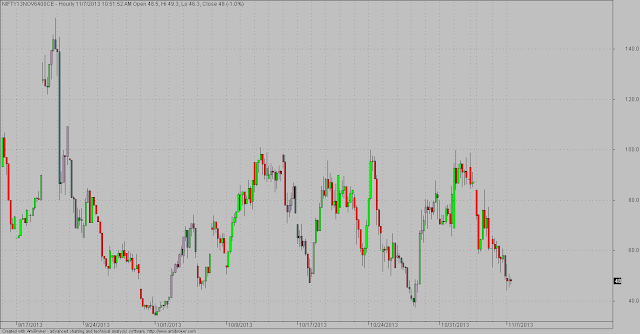

Hourly chart showing the trendline :

This become a strong LOC (Line of Control) for the bulls and bears now.

The original trend should continue if the trendline is not crossed.

The high on Nifty spot today is bang on the trendline right from 1st October.

Hourly chart showing the trendline :

This become a strong LOC (Line of Control) for the bulls and bears now.

Tuesday, October 22, 2013

A low risk bet for November

Logic of the low risk November PE is simple.

As seen form the chart, this PE has declined from 180 all the way to a low near 9 today.

Nifty on daily charts is very close to being overbought, and there are very good chances of Nifty seeing a correction now.

Bulls can call it a correction, bears can call it a crash, but this low risk PEs (even 5500 or 5600 PE)

are worth buying to have an insurance against any crash / correction in November.

It is highly unlikely that Nifty will keep going up.

As seen form the chart, this PE has declined from 180 all the way to a low near 9 today.

Nifty on daily charts is very close to being overbought, and there are very good chances of Nifty seeing a correction now.

Bulls can call it a correction, bears can call it a crash, but this low risk PEs (even 5500 or 5600 PE)

are worth buying to have an insurance against any crash / correction in November.

It is highly unlikely that Nifty will keep going up.

Monday, October 21, 2013

Thursday, October 17, 2013

What can be the target ?

Given below is an hourly chart.

It has broken a trendline, and is headed downwards.

What can be the target?

1. The green band? (G)

2. The blue band ? (B)

3. Or the red band? (R)

4. Failed breakdown and will go up? (U)

Please answer only in G, B, R or U in the ‘comments’.

First lottery after a long time

5900 PE is showing initial signs of bottoming out.

One can buy near 30-32, with a strict stop loss below 25.

If SL is respected, it can give a good run.

Wednesday, October 9, 2013

Why Nifty didn’t go to the upper trend line?

Chart updated. Resistance from trendline from previous high.

Short on rise, SL this time based on SPOT 5985.

Potential Options trade

RCOM 160 ce is a good buy if it dips to 4.5 or lower;

Can be bought with a Sl near 3, for a target near 10-12

or even 16.

Please note lot size of R Com is 4000, hence risk per lot can be

Rs. 6000 or more !

Subscribe to:

Comments (Atom)