online poll by Opinion Stage

Thursday, November 28, 2013

Wednesday, November 27, 2013

Saturday, November 23, 2013

A classic case of Pump and dump

On 23rd October I happened to receive a text message on my mobile recommending to buy a BSE stock - CUPID TRADE for a target of upper circuit !!

Although I never act on such messages, out of curiosity, as I always do, I decided to check the chart. This stock happens to be listed only on BSE. Since I have charts for all BSE and NSE stocks (historical too), I checked the chart till the previous day, and saw this :

On first glance, it was clearly in an uptrend but with thin volumes (the 20 day moving average of volumes was just 14,400 till that day).

The SMSs to buy increased and then I realised that it was in lower circuit already at 263.1 with a huge volume of 3.79 lakh shares. So the target mentioned was 22% from that price, that too intra day !

The text messages continued till 12 noon and one of the messages was:

I started tweeting about it, and following are my tweets on that stock:

I also saw the long term chart which told a story:

What is the status of that stock today? Here is the latest chart:

The stock has been in lower circuit every single day since that fateful day (22 days), with volumes in 2 and 3 digits.

Imagine the plight of those who bought it on 23rd October based on those SMS messages !!

Moral of the story: DO NOT BUY ANYTHING BLINDLY EVEN IF THE SMS IS FROM GOD !!

Although I never act on such messages, out of curiosity, as I always do, I decided to check the chart. This stock happens to be listed only on BSE. Since I have charts for all BSE and NSE stocks (historical too), I checked the chart till the previous day, and saw this :

On first glance, it was clearly in an uptrend but with thin volumes (the 20 day moving average of volumes was just 14,400 till that day).

The SMSs to buy increased and then I realised that it was in lower circuit already at 263.1 with a huge volume of 3.79 lakh shares. So the target mentioned was 22% from that price, that too intra day !

The text messages continued till 12 noon and one of the messages was:

I started tweeting about it, and following are my tweets on that stock:

I also saw the long term chart which told a story:

What is the status of that stock today? Here is the latest chart:

The stock has been in lower circuit every single day since that fateful day (22 days), with volumes in 2 and 3 digits.

Imagine the plight of those who bought it on 23rd October based on those SMS messages !!

Moral of the story: DO NOT BUY ANYTHING BLINDLY EVEN IF THE SMS IS FROM GOD !!

Friday, November 22, 2013

Sunday, November 17, 2013

A low risk trade idea

Tata Steel has given a strong upmove in the last couple of months and has done well even after results were declared last week.

There is a strong resistance between 376 and 379 (cash), and the stock can give a decline / pullback as long as this resistance is not crossed.

One can buy a Put near the resistance or go short in futures, or go short in 380 CE with a stop loss above 381 cash level.

There is a strong resistance between 376 and 379 (cash), and the stock can give a decline / pullback as long as this resistance is not crossed.

One can buy a Put near the resistance or go short in futures, or go short in 380 CE with a stop loss above 381 cash level.

Range-bound November ?

As mentioned at the start of the November series, this month seems to be a range-bound month as far as Nifty is concerned, between 5950 and 6300.

Nifty seems to have bottomed out for the short term at 5972, but there are resistances near 6140-50 and then 6200-6220.

This view is also supported by the PCR charts, which show a very strong support near 5900-5950 and the support at 6000 is still not very strong.

The PCR at 6100 strike price will provide the hint as regards the way Nifty will move forward. The upmove can gather steam only if the PCR at 6100 moves above 1.25.

This upmove can be halted by supports for the 6100 PE in the range 55-65 and then between 35 - 40.

Nifty seems to have bottomed out for the short term at 5972, but there are resistances near 6140-50 and then 6200-6220.

This view is also supported by the PCR charts, which show a very strong support near 5900-5950 and the support at 6000 is still not very strong.

The PCR at 6100 strike price will provide the hint as regards the way Nifty will move forward. The upmove can gather steam only if the PCR at 6100 moves above 1.25.

This upmove can be halted by supports for the 6100 PE in the range 55-65 and then between 35 - 40.

Thursday, November 7, 2013

Wednesday, November 6, 2013

Tuesday, November 5, 2013

Monday, November 4, 2013

A study based on Options for November

With Nifty futures and sensex having made all time highs, and Nifty spot threatening to do so, here is a study based on Options to try and see what Nifty can do in November.

Based on the Options data, it appears Nifty might remain rangebound within 6100 to 6400 range.

This study based on Options is a bit too early, and can change pretty fast, but any change spotted will be highlighted here immediately.

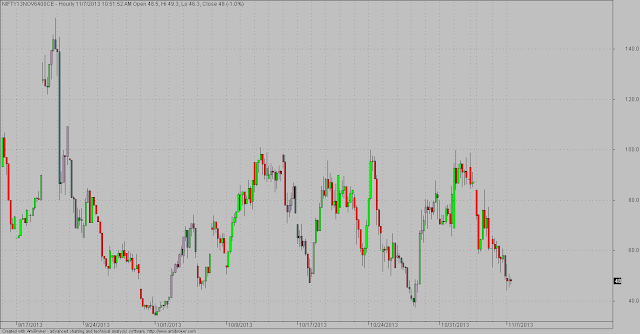

The 6400 CE chart shows a resistance near the 100 area, and support near the 35-40 area.

One can safely short either the CE or Nifty futures near the resistance zone for a target near the support band.

The current difference is about 50 points on the 6400 CE which means a downside of about 100-150 points on Nifty futures, which gives a target of approximately 6150 on Nifty Spot.

A look at the PCR at various strike prices also reveals a similar scenario.

The PCR at 6300 is still 0.87, thus indicating that Nifty spot is not comfortable above 6300 (CMP 6317).

The PCR at 6400 is extremely less at 0.24 and bulls do not seem to be serious as of now to plan an assault on that level.

On the lower side PCR at 6000 and 6100 is very strong, thus indicating that breaking these levels is going to be difficult in the near future.

Keeping a close watch on how these PCR values change over the next few days will give further hints.

As of now 6150 - 6320 seems to the range for Nifty spot.

TRADE IDEAS:

Go short on rise with that level of 6400 CE as SL (100-102);

Go long on any dip near 6150, with SL as 35-40 on 6400 CE.

Based on the Options data, it appears Nifty might remain rangebound within 6100 to 6400 range.

This study based on Options is a bit too early, and can change pretty fast, but any change spotted will be highlighted here immediately.

The 6400 CE chart shows a resistance near the 100 area, and support near the 35-40 area.

One can safely short either the CE or Nifty futures near the resistance zone for a target near the support band.

The current difference is about 50 points on the 6400 CE which means a downside of about 100-150 points on Nifty futures, which gives a target of approximately 6150 on Nifty Spot.

A look at the PCR at various strike prices also reveals a similar scenario.

The PCR at 6300 is still 0.87, thus indicating that Nifty spot is not comfortable above 6300 (CMP 6317).

The PCR at 6400 is extremely less at 0.24 and bulls do not seem to be serious as of now to plan an assault on that level.

On the lower side PCR at 6000 and 6100 is very strong, thus indicating that breaking these levels is going to be difficult in the near future.

Keeping a close watch on how these PCR values change over the next few days will give further hints.

As of now 6150 - 6320 seems to the range for Nifty spot.

TRADE IDEAS:

Go short on rise with that level of 6400 CE as SL (100-102);

Go long on any dip near 6150, with SL as 35-40 on 6400 CE.

Subscribe to:

Posts (Atom)